External Audit

- Home

- Service

- Audit&Assurance

- External Audit

External Audit Service in Bahrain

External Audit Service is just an examination and comment on the objects confirmed. A financial audit under a Best External Audit services in Bahrain entails a review of the ledgers and other pertinent documents. This will offer the auditor of a Top External Audit firm in Bahrain the data he needs to determine if the accounts have been kept up to date and have complied with all applicable legal, accounting, and financial reporting requirements.

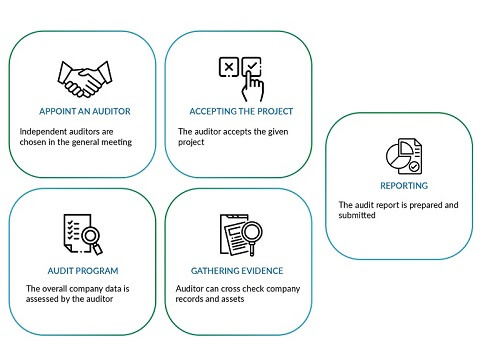

External Audit Process

A well-planned verification is necessary to cover all financial items with audit materiality. An audit involves the collection and evaluation of evidence in support of conclusions arrived from the Best External Audit services in Bahrain. The procedures which will assist the auditor in this direction are:

- Planning and risk assessment: Involves gaining an understanding of the business and the business environment in which it operates, and using this information to assess whether there may be risks that could impact the financial statements

- Internal controls testing: Involves the assessment of the effectiveness of an entity’s suite of controls, concentrating on such areas for proper authorization, safeguarding of assets and the segregation of duties.

- Substantive procedures: Involves a broad array of procedures, of a small sampling.

- A Complete and Comprehensive business report.

- Ensures that all the compliance requirements of the jurisdiction are followed.

- As it is conducted by a third party, it will also provide a different perspective on how to manage the business.

- Assists the management in the judicious and proper utilization of resources, thus curbing wastage.

- Increases the confidence of the investors and will bring in more investors.

- Helps to understand the workings of the business and will prepare it for the future.

The different levels of assurances from the auditor’s point of view

An audit of a Top External Audit firm in Bahrain provides a high level of assurance. But a review engagement gives a reasonably lesser degree of assurance than an audit. As in a review, the auditor does not carry out all those procedures that are carried out in an audit. Publicly held entities must have their quarterly financial statements reviewed, in addition to the annual audit.Sometimes the requirement is only to report on individual items of financial data or on a set of financial statements to report on the factual findings, say to certify only the turnover of the company.The level of assurance in such agreed-upon procedures is again lower than in a review engagement. In the case of a compilation engagement, the auditor is called upon to prepare the financial statements – where his expertise in collecting, classifying and summarizing the financial information is only demanded and not designed to give any assurance on the financial statements.

- Revenue

- Procurement of Goods/ Services

- Inventory

- Logistics

- Information Technology Infrastructure.

- Finance

- Fixed Assets

- Statutory Compliance

- Admin & general Operations, etc.

There are many different reasons why a company requires an External Audit. Some of the benefits of External Audit to a business are as follows:

- An External Audit provides an outlook about the business from an external point of view which can help the management to understand the business as well as the business environment.

- It provides a benchmark to the businesses and also assists the management in planning for the future.

- There are many compliance requirements that need to be fulfilled by a business, and an external audit helps in ensuring compliance.

- An external Audit helps in increasing the credibility of the business and also helps in attracting more and more investors.

Before embarking on a journey to conduct an External Audit for your company, there are some points which should be kept in mind by the management. Some of the important points to keep in mind are:

- First and foremost, the management should understand the basics of how an External Audit works and what results that can be obtained from it.

- After understanding how the external Audit works, the management should obtain all the documents which will be required in the process.

- In certain scenarios, it is not possible for the management to conduct an internal audit themselves. In such circumstances, the management needs to hire an expert who will understand the requirements of the business and will provide a solution accordingly.

This is why it is suggested that the management should take the assistance of a reputed firm which will take care of all the auditing requirements of the company.

There are two different types of Audits available to a business, namely Internal Audit and External Audit. These audits provide similar end results but are different from each other.

As it will be a continuous process, the scope does not end with the submission of reports. The follow-up action taken report (ATR) will be presented to the management on the status of observations and its closure status. Any long-pending observations critical to the business will be bought to the notice of the management to set a further course of actions.

Independent review and appraisal of the organization’s financial and relevant operational activities will be better when the auditor is not part of the organization and is independent.

GSPU is an Audit Firm offering a wide range of business services, including accounting, auditing, software consultancy and management. We have been providing the best audit services in Bahrain and other areas as well. At GSPU, we follow precise and proven approach to ensure that every item requiring investigation and verification of financial records are properly substantiated. Out External Audit Covers:

- Analysis of business performance against predetermined management objectives.

- Examining the accounting records and checking other evidence supporting financial statements.

- Assessment of business risks and providing the relative suggestions.

Follow-up & action taken Reports.

How GSPU can help

Examines books of accounts by standard

auditing procedures

Our auditor expresses his/her opinion on whether the

accounts have been properly maintained and whether

they have met all auditing requirements.

Analyze social media strategy on various platforms,

as well as competitors

We analyze lead generation from social media driving traffic

to your website and analyze the engagement on your

social platforms.

Ensures that the company's risk-reduction

procedures

We create risk assessment systems for global, financial,

general, economic, political, industry, and company-

specific hazards.

Assists in Future Planning

Businesses will be better prepared to face official tax audits

if they have all of the relevant material produced by us and

avoid errors caused by hurry at the last minute.

Inquires company entity's financial, legal, &

other statutory compliances

We examine a business entity before entering into a contract

or other agreement that calls for a certain standard of care.

Assists the organization in the prevention of fraud

Based on our analysis of the company's questionable financial

and operational records, we produce a fraud investigation report.

Contact us

+973 -38393646

info@gspubahrain.com

Form

GSPU CHARTERED ACCOUNTANTS

P.O. Box 76023, Office 35,

Building 2304,

Block: 428,

Road 2830, AlSeef,

Bahrain

SUPPORT

E-mail:info@gspubahrain.com

Phone:+973 17008944,+973 33160433

website:www.gspubahrain.com

GSPU AUDITING OF ACCOUNTS

GSPU TAX CONSULTANCY LLC

Office No.60, Victor Business Center, 13th Floor, Sky Lobby, Burjuman Business Tower, Bur Dubai, UAE

SUPPORT

E-mail:info@gspuuae.com

Phone:+971 528532600, +971 589141671

website:www.gspuuae.com

G S P U & ASSOCIATES LLC CHARTERED ACCOUNTANTS

Block No:250, Street,No: 319,Building no:09/1Bausher Ghala, Industrial Area,

Muscat,Oman

SUPPORT

E-mail:info@gspuoman.com

Phone:+968 96090952,+968 96090953

website:www.gspuoman.com

G S P U & ASSOCIATES LLC CHARTERED ACCOUNTANTS

Syam Scion, PMG, Law College Road,

Vikas Bhavan P.O. Thiruvananthapuram,

Kerala,pin-695033.

SUPPORT

E-mail:gspuindia@gmail.com

Phone:+91-8590790111, 9847236982

website:www.gspuca.com