Business valuation

- Home

- Service

- Business Consulting

- Business valuation

Business Valuation in Bahrain

A business owner or firm may need to know the value of a business for multiple reasons; including when the time comes to sell or buy a business, settle a legal dispute, restructure capital, expand a business, etc.

A qualified professional from a Top Business valuation firm in Bahrain with the necessary credentials should perform the in-depth financial analysis necessary for the Best Business valuation in Bahrain. Small business owners that opt for a free business assessment & Best Business valuation in Bahrain drastically undervalue the benefits they gain from an exhaustive valuation by experts of a Top Business valuation firm in Bahrain. These advantages assist business owners in negotiating a strategic sale of their company to obtain a fair price, reduce the management’s financial risk in a legal proceeding, etc.

Information covered in our business valuation report

- Financial projections and Fund Utilization Strategies

- Company Profile and Promoter Background;

- Industry Outlook & Geographic Prospectus

- Proposed Market Penetration Strategies

- ROI and Other Relevant Financial Parameters for Prospectus Evaluation

- Valuation of Business and Key Evaluation Parameters

1.How should a company or business be valued?

1.Internal assessment

It connects an asset’s value to its intrinsic qualities, including its ability to produce cash flows and the risk associated with those cash flows. When cash flows are more predictable for the business, intrinsic value is most often calculated using a discounted cash flow valuation, where the value of an asset equals the present value of anticipated future cash flows on that asset.

2.Comparative valuing

By comparing the prices of “similar” assets to a common variable, such as earnings, cash flows, book value, or sales, it calculates the value of an asset.

3.Value of contingent claims

To calculate the value of assets that share option characteristics, it uses option pricing models.

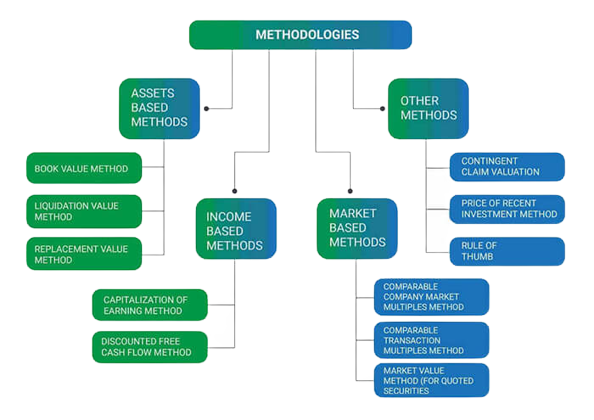

Additional techniques to evaluate the worth of a business.

How to determine the worth of a company or business

.Asset techniques: To determine the worth of the entire business enterprise, the asset approach to business valuation takes into account the underlying business assets. This method is based on the substitution economic concept and aims to calculate the costs of re-creating a company of equivalent economic usefulness, that is, a company that can generate the same returns for its owners as the subject company.

The asset approach’s company valuation techniques include:1.The book value method.

2.Replacement value method

3.Liquidation value method

Market technique: According to the market approach to business valuation, one looks to the market for cues as to what a company is worth. Most frequently, sales of businesses that are similar to the one being analyzed are examined to get comparative data that may be utilized to calculate the subject business’s value. This strategy makes advantage of the economic principle of competition, which aims to determine the worth of a company by comparing it to others of a similar nature whose value has previously been determined by the market.

The market approach business valuation techniques include:

1.Comparative company market multiple approaches

2.Comparable transactions using various techniques

3.Market value approaches (Quoted securities)

Income sources: The income approach to business valuation bases its assessment of a company’s value on the economic idea of expectation. To achieve this, one makes projections of the future profits the company owners can anticipate from the in-focus enterprise. The risk involved in getting them fully and on time is then compared to these returns.

The returns are projected as either a one-time sum or as a future stream of income for the company’s owners. Following that, the risk is measured using what is known as capitalization or discount rates.

Direct capitalization strategies are those that rely on a single indicator of business earnings. The discounting methods are those that make use of a stream of revenue.

The worth of the commercial enterprise is determined as the present value of the anticipated income stream using discounting procedures, which directly account for the time value of money.

The Income Approach includes the following methods:

1.Discounted Cash Flow Method

2.Price to Earnings or Earnings Multiples or Capitalizing Earnings Methods

Other Methods: Other approaches to corporate appraisal include the following:

1.Valuing contingent claims

2.Cost of a recent investment strategy

Rule of thumb

An asset or liability may be valued differently using any of the aforementioned methods. Using a variety of business valuation techniques under each methodology is standard practice.

Typically, each business valuation method is compared by giving each result a “weight”. The worth of the analyzed business is then calculated using the sum of the weighted results.

2. How to price a company?

Fair market value is frequently used as the standard of value. The fair market value is the price at which a business would be sold between two independent parties who each had the necessary knowledge and information, were not the subject of any undue pressure, and had access to all the data necessary to make an informed choice. When valuing a firm, an analyst considers factors such as management, capital structure makeup, expected future earnings, the market value of assets, etc.

It is a common assumption that the value of a company is a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization) because it does not take into account industry, business risks, expected cash flows, debts, etc. Therefore, it is always recommended to have a business valuation done by a valuation specialist. Without knowing the true fair market value of the business, the trader may sell the business for a loss. For these reasons, a business appraisal can be a good investment.

How GSPU can help

Incorporates into the Company Valuation Process

There are many reasons why a business owner or company need to know the value of a business is taken at the time to sell.

Compete in the risk-taking world

Everybody in the company is exposed to risk in one way or another. The way the risk is managed has a significant impact and seeks an expert.

Examines the market thoroughly

A thorough market analysis to assess the potential opportunities could protect the organisation from joining dangerous enterprises blindly.

Increases cyber security coverage

The current corporate environment is very disruptive, and cybercrime is at an all-time high, producing nightmare scenarios. As a result, your cyber security network is strengthened.

Correctly manages finances with knowledge and planning

Corporate finance is a very difficult and sophisticated field of finance, and we deal with it effectively using our knowledge and planning.

Creates a Standard Procedure to enhance output quality and consistency

Step-by-step guidelines are created by GSPU to assist employees in doing difficult routine tasks.

Contact us

+973 -38393646

info@gspubahrain.com

Form

GSPU CHARTERED ACCOUNTANTS

P.O. Box 76023, Office 35,

Building 2304,

Block: 428,

Road 2830, AlSeef,

Bahrain

SUPPORT

E-mail:info@gspubahrain.com

Phone:+973 17008944,+973 33160433

website:www.gspubahrain.com

GSPU AUDITING OF ACCOUNTS

GSPU TAX CONSULTANCY LLC

Office No.60, Victor Business Center, 13th Floor, Sky Lobby, Burjuman Business Tower, Bur Dubai, UAE

SUPPORT

E-mail:info@gspuuae.com

Phone:+971 528532600, +971 589141671

website:www.gspuuae.com

G S P U & ASSOCIATES LLC CHARTERED ACCOUNTANTS

Block No:250, Street,No: 319,Building no:09/1Bausher Ghala, Industrial Area,

Muscat,Oman

SUPPORT

E-mail:info@gspuoman.com

Phone:+968 96090952,+968 96090953

website:www.gspuoman.com

G S P U & ASSOCIATES LLC CHARTERED ACCOUNTANTS

Syam Scion, PMG, Law College Road,

Vikas Bhavan P.O. Thiruvananthapuram,

Kerala,pin-695033.

SUPPORT

E-mail:gspuindia@gmail.com

Phone:+91-8590790111, 9847236982

website:www.gspuca.com