An analysis of an idea’s viability is known as a feasibility study. It determines the chance of completing the project by taking into account all pertinent economic, technical, legal, and scheduling concerns. The management of a corporation might also benefit from feasibility studies by receiving crucial information that could prevent it from pursuing risky ventures blindly. A properly conducted and studied feasibility study may identify potential problems that might occur during project implementation and explain potential financial, operational, and other organizational implications. After taking into account all the relevant aspects, it decides whether the project will be productive. Our organizational consultants have in-depth knowledge of creating business plans and performing feasibility studies, so if you want to research that aids in addressing your worries, offers a planned viewpoint, and gives an impartial assessment of your hopeful ideas, they can help.

Advantages of performing a feasibility study

- Reduces the variety of business plans

- Directs business in the appropriate direction

- Businesses can uncover the opportunities that are available by conducting a thorough market analysis.

- Address the shortcomings of their opponents

Financial Dimension

In this step Feasibility Study, the start-up costs, ongoing costs, financing options, and profitability are examined. At this point, the fixed and variable costs as well as the legal and capital acquisition costs are calculated. Understanding the ramifications and costs associated with various financing alternatives helps identify the best method of raising money, whether it be through loans, investments, or other means. Additionally determined are the anticipated return on investment and estimated income. To ensure a healthy cash flow, the conditions of payment for the supplier and the client are also decided. Every financial feasibility study report will generally include the following:

- Income Statement

- Projected Statement of Financial Position

- Income Statement

- Payables Statement

- Financial Projections Notes & Explanations.

- BEP Ratio Analysis VI

Technical Dimension

This step of the feasibility study involves analyzing the resources required for the company. Aspects of facilities and equipment that need to be considered include the hardware/software requirements, the source and availability of capital assets, and if an expansion or change in line can be accommodated with the capital being invested. The factors to be taken into consideration when it comes to labour and management include the amount of necessary manpower, the technical know-how they should possess, the training that should be given, and the competency and experience of managers.

- Price of the technology

- Price of technological development

- Price of consulting support (design and implementation)

- Price of the organisation for piloting training

- Ongoing cost.

Schedule

At this stage, the timeline for business setup is chosen. Even though market research takes time, a workable business plan needs to be implemented quickly because the industry is so dynamic. To guarantee that the business’s aims and objectives are achieved, the business plan must be implemented within the allotted time frame.

Feasibility of the operation

We employ the PIECES framework with the feasibility study, which aids in determining the issues that need to be resolved and their criticality:

- Performance: Does the throughput and response time offered by the modes of operation meet the needs?

- Information: Do end users and management have access to current, relevant, accurate, and well-formatted information?

- Economy – Does the method of operation offer the company cost-effective information services? Could there be an increase in benefits and/or a decrease in costs?

- Control: Does the method of operation offer enough safeguards against fraud and that data and information are accurate and secure?

- Effectiveness – Does the method of operation make the best use of the people, time, and flow of forms?

- Services: Does the method of operation offer dependable service? Is it extensible and flexible?

Our Priority Sectors

Market Stability

In this stage of the feasibility study, the internal and external market conditions are researched. Analysis of the current and projected market circumstances, identification of the key players, and determination of their strengths and weaknesses help close the gap. The new product or service is compared to others already on the market, the unique qualities that give it an advantage over those items are understood, and its ability to address any market needs is evaluated. In this phase, the value proposition to the clients is decided after research into the target customers’ receptivity and identification of the delivery channels.

Market Stability

- Individual interview

- Telephone conversation

- Surveys

Internal sources for desk research

- Sales amount

- Accounting sources

- Customer comments and grievances

- Report from the sales representative

Online investigation

- Searching tools

- Newspapers

- Other online databases

- Report from the sales representative

Printed Study

- Commercial statistics

- Reports on industrial market research

- Commercial directories

Additional Market Research

- Industry Trend

- Market Sector

- Targeted Clientele

- Target Market Research

- Pricing Methodology

- Competitive Environment

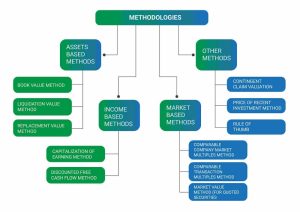

There are just three valuation methodologies, even if there are many valuation models and indicators available:

Internal assessment

It connects an asset’s value to its intrinsic qualities, including its ability to produce cash flows and the risk associated with those cash flows. When cash flows are more predictable for the business, intrinsic value is most often calculated using a discounted cash flow valuation, where the value of an asset equals the present value of anticipated future cashflows on that asset.

Comparative valuing

By comparing the prices of “similar” assets to a common variable, such as earnings, cashflows, book value, or sales, it calculates the value of an asset.

Value of contingent claims

To calculate the value of assets that share option characteristics, it uses option pricing models.

Based on the three methodologies mentioned above, there are three primary ways and additional techniques to evaluate the worth of business practice:

- Asset techniques: To determine the worth of the entire business enterprise, the asset approach to business valuation takes into account the underlying business assets. This method is based on the substitution economic concept and aims to calculate the costs of re-creating a company of equivalent economic usefulness, that is, a company that can generate the same returns for its owners as the subject company.

The asset approach’s company valuation techniques include:

- The book value method.

- Replacement value method

- Liquidation value method

- Market technique: According to the market approach to business valuation, one looks to the market for cues as to what a company is worth. Most frequently, sales of businesses that are similar to the one being analyzed are examined to get comparative data that may be utilized to calculate the subject business’s value. This strategy makes advantage of the economic principle of competition, which aims to determine the worth of a company by comparing it to others of a similar nature whose value has previously been determined by the market.

The market approach business valuation techniques include:

- Comparative company market multiple approaches

- Comparable transactions using various techniques

- Market value approaches (Quoted securities)

- Income sources: The income approach to business valuation bases its assessment of a company’s value on the economic idea of expectation. To achieve this, one makes projections of the future profits the company owners can anticipate from the in-focus enterprise. The risk involved in getting them fully and on time is then compared to these returns.

The returns are projected as either a one-time sum or as a future stream of income for the company’s owners. Following that, the risk is measured using what is known as capitalization or discount rates. Direct capitalization strategies are those that rely on a single indicator of business earnings. The discounting methods are those that make use of a stream of revenue. The worth of the commercial enterprise is determined as the present value of the anticipated income stream using discounting procedures, which directly account for the time value of money.

The Income Approach includes the following methods:

- Discounted Cash Flow Method

- Price to Earnings or Earnings Multiples or Capitalizing Earnings Methods

- Other Methods: Other approaches to corporate appraisal include the following:

- Valuing contingent claims

- Cost of a recent investment strategy

- Rule of thumb

The same object may be valued differently at the same moment using any of the aforementioned methods. We must be able to comprehend and use each technique to fully understand valuation. Each strategy has a proper time and place and knowing when to utilise each one is essential to mastering value. There isn’t a single, infallible method or approach for business appraisal. Therefore, using a variety of business valuation techniques under each methodology is standard practice. The business value is then calculated by comparing the outcomes of the chosen methodologies. Typically, each business valuation method’s output is given a weighting. The worth of the analysed business is then calculated using the sum of the weighted results.

Business valuation refers to the process of determining the present worth of a firm and there are various approaches used to determine value. Fair market value is frequently used as the standard of value. The fair market value is the price at which a business would be sold between two independent parties who each had the necessary knowledge and information, were not the subject of any undue pressure, and had access to all the data necessary to make an informed choice. When valuing a firm, an analyst considers factors such as management, capital structure makeup, expected future earnings, the market value of assets, etc.

It is a common mistake to say that the value of a company is a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization) because it does not take into account industry, business risks, expected cash flows, debts, etc. Therefore, it is always recommended to have a business valuation done by a valuation specialist. Without knowing the true fair market value of the business, the trader may sell the business for less or buy for its true value. For these reasons, a business appraisal can be a good investment. Sometimes millions can be saved by paying the right price or making the right decision not to invest in a bad business.